federal income tax definition

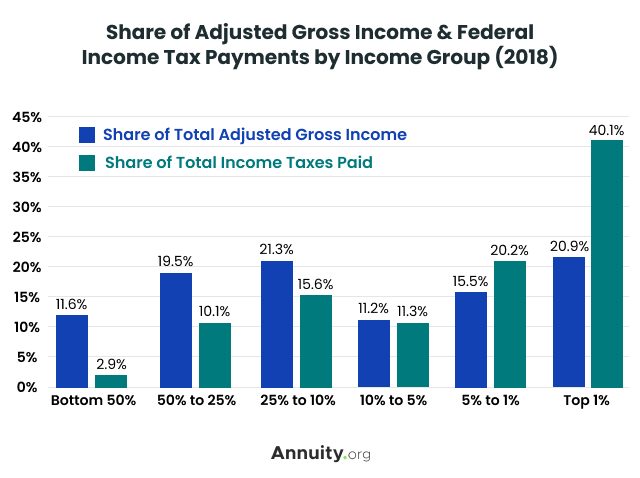

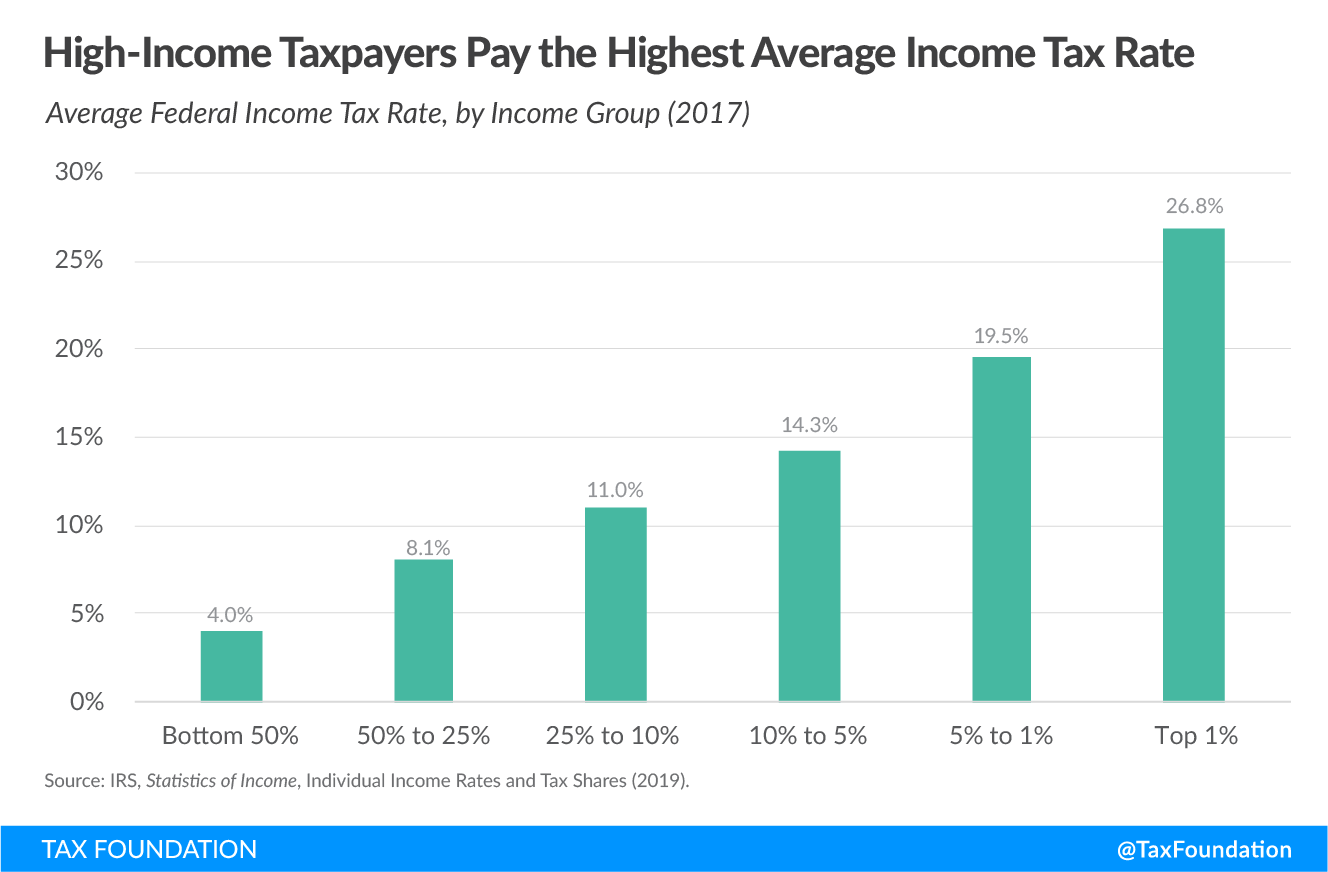

Income taxes can be levied on both individuals personal income taxes and businesses business and corporate income taxes. Tax Code Part I.

Income Tax Definition What Are Income Taxes How Do They Work

Imposes a federal income tax on its citizensboth those who live in the US.

. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the Internal Revenue Code or state law. Federal income tax is a tax levied by the Internal Revenue Service IRS on the annual earnings of individuals c Automobile. Other important definitions like taxable income and adjusted gross income can also be found in 26 US.

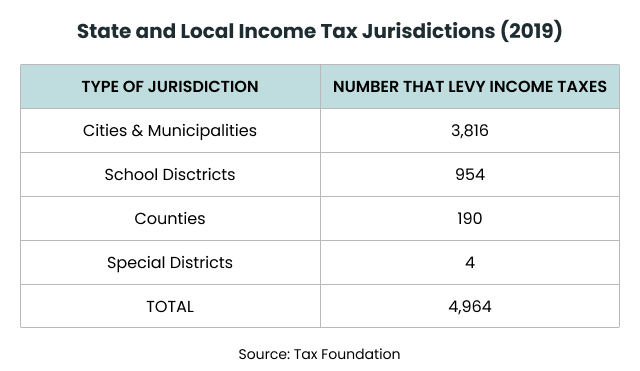

These taxes are typically applied to a percentage of the income but the rate may vary based on the type of income amount of income or the type of taxpayer. Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses. You pay FUTA tax only from your own funds.

A tax levied on the annual earnings of an individual or a corporation. Income taxes are levied by the federal government and by a number of state and local governments. Some terms are essential in understanding income tax law.

An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax. Your 2021 Tax Bracket To See Whats Been Adjusted.

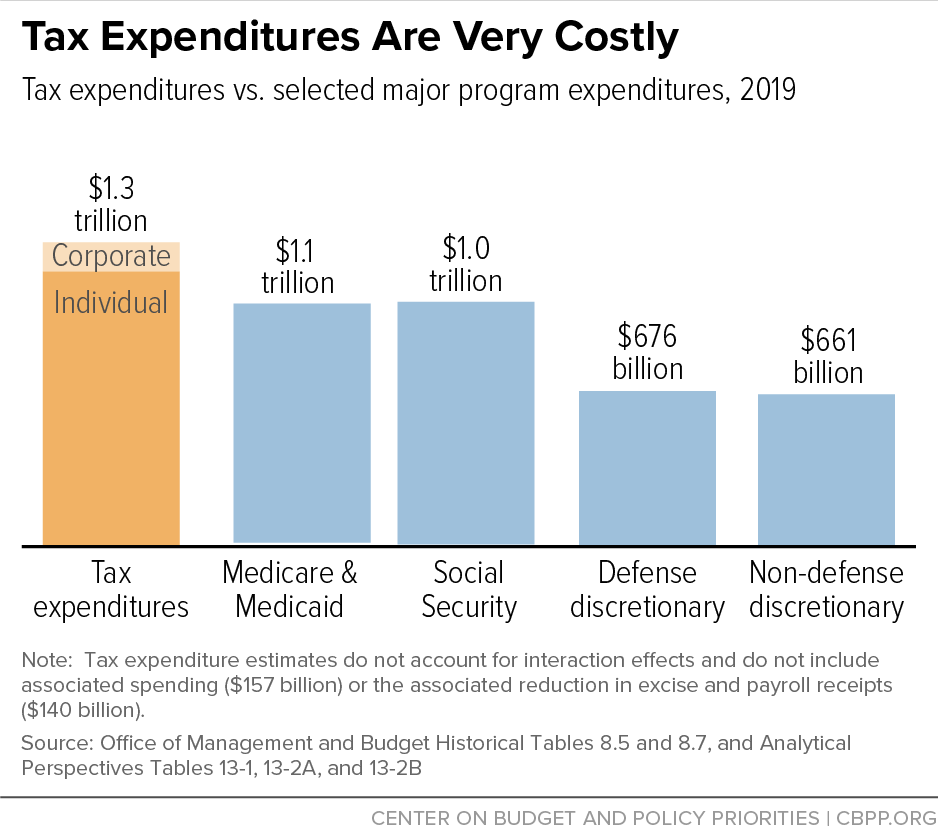

Taxes have been called the building block of civilization. The size and structure of an income tax greatly influence security prices and investor decisions. Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax.

By law businesses and individuals must file an income tax. What Is Federal Income Tax. Employees do not pay this tax or have it withheld from their pay.

Heres how the IRS defines income tax. An income tax is a type of tax that is imposed on an individuals or businesss earned and unearned income. Refer to Publication 15 and Publication 15-A Employers Supplemental Tax Guide for more.

American Heritage Dictionary of the English Language Fifth Edition. A tax levied on net personal or business income. And those who live abroadas well as on its resident aliens.

Paying the Federal. Taxes on income both earned salaries wages tips commissions and unearned interest dividends. A tax levied on net personal or business income.

Gross income can be generally defined as all income from whatever source derived a more complete definition is found in 26 USC. Federal Unemployment FUTA Tax. Definition and Example of Income Tax.

1 et seq gross income of the donor shall not include any amount attributable to the donees payment of or agreement to pay any gift tax imposed with. Discover Helpful Information And Resources On Taxes From AARP. A tax on an individuals net income after deductions for various expenses and payments such as charitable gifts calculated on a formula which takes into consideration whether it is paid jointly by a married couple the number of dependents of the taxpayers special breaks for ages over 65 disabilities and other factors.

Ad Compare Your 2022 Tax Bracket vs. Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes. This income tax generates most.

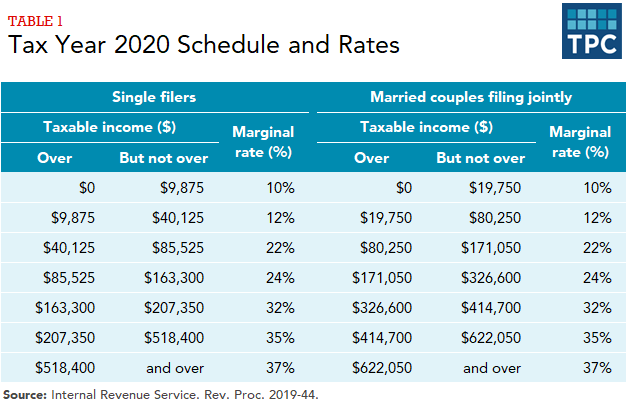

Information about rate schedule federal income tax in. W E Snelling Dictionary of income tax and sur-tax practice incorporating the provisions of the Income tax act 1918 and the Finance acts 1919 to 1930 for the use of professional and business men accountants etc. American Heritage Dictionary of the English Language Fifth Edition.

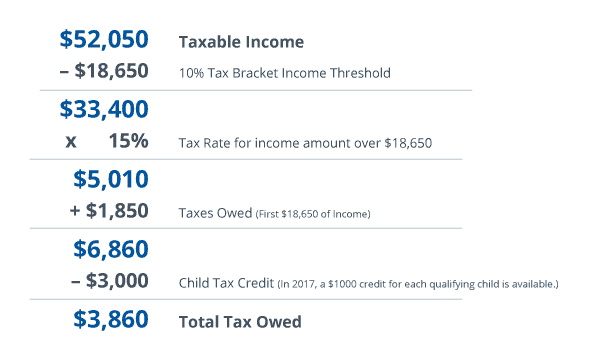

Federal income taxes are paid by individuals in proportion to their earnings after reducing the considered earnings by the allowable tax deductions. London New York Sir I. For example the US.

The taxes that most people worry about though are federal income taxes. In fact taxes. In the case of any transfer of property subject to gift tax made before March 4 1981 for purposes of subtitle A of the Internal Revenue Code of 1986 formerly IRC.

One set of rules applies to individual income and another to corporate income. The revenue generated from this tax is used to pay for all sorts of federally-overseen programs agencies the military interstate highways and much more. Federal income tax is only one of the.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Average Tax Rate Definition Taxedu Tax Foundation

/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)

Taxes Definition Types Who Pays And Why

Types Of Taxes Income Property Goods Services Federal State

Income Tax Definition What Are Income Taxes How Do They Work

Corporate Income Tax Definition Taxedu Tax Foundation

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Average Tax Rate Definition Taxedu Tax Foundation

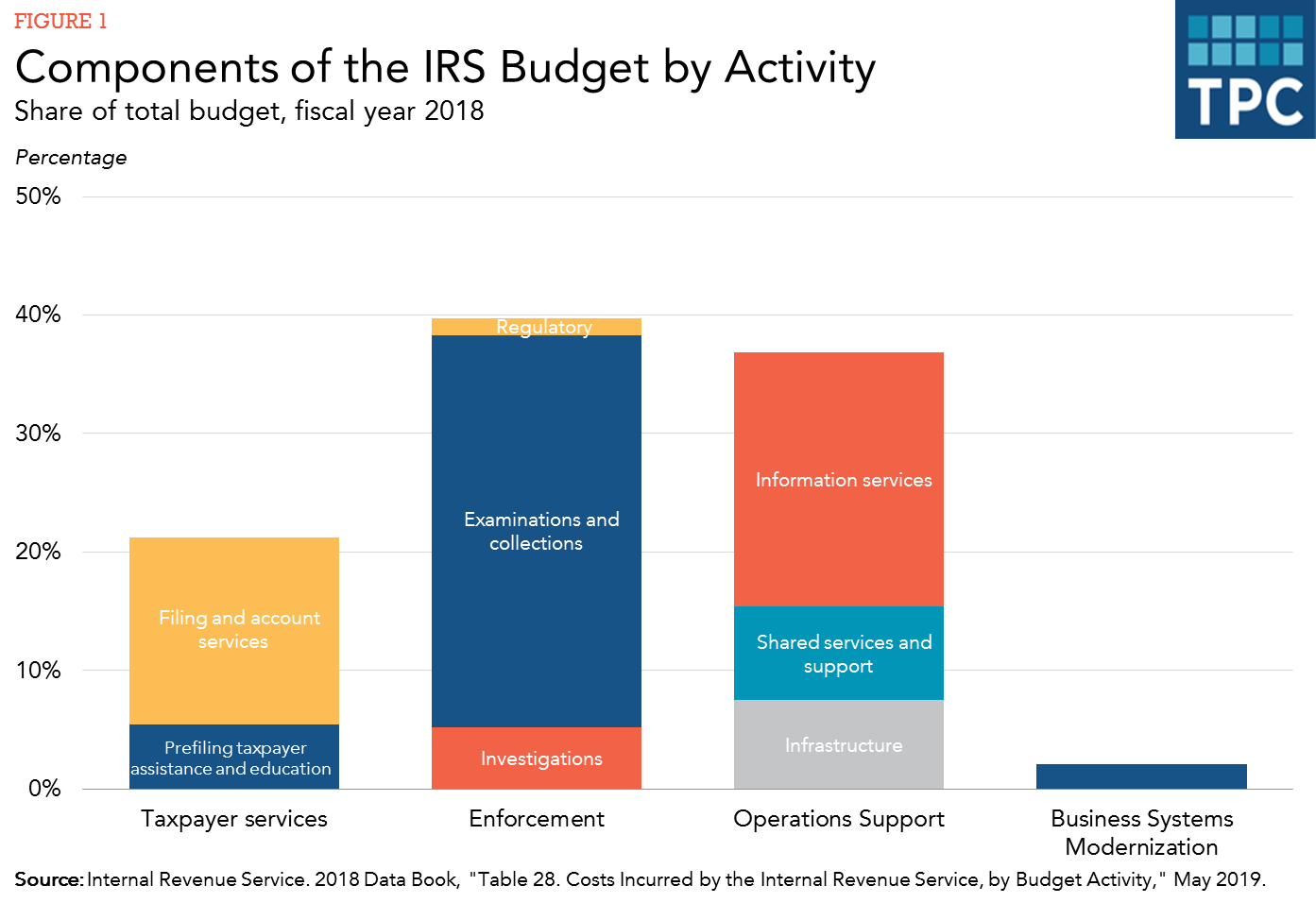

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Government Revenue Taxes Are The Price We Pay For Government

What Is Local Income Tax Types States With Local Income Tax More

Standard Deduction Tax Exemption And Deduction Taxact Blog

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Tax Rate Calculator Sale Online 57 Off Www Ingeniovirtual Com

Tax Rate Calculator Sale Online 57 Off Www Ingeniovirtual Com

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)